When the very first Williston Basin Petroleum Conference was envisioned back in 1993, it was planned as a meeting where researchers and industry leaders could sit down and discuss the latest technologies and science to help improve oil production in North Dakota and Saskatchewan. That first conference in Minot, North Dakota – spearheaded by Dr. Malcolm Wilson who at the time worked for the Saskatchewan Ministry of Industry and Mines, as well as colleagues across the border at the University of North Dakota – sent out 70 invitations. Over 160 people showed up.

From the get-go, Wilson and the original planners knew they’d come across something big.

“What can you say when you get almost triple the number of people you initially invited to the first conference asking to attend?” notes Wilson, now the CEO of the Petroleum Technology Research Centre in Regina, Saskatchewan. “As the conferences progressed – and began to be managed by the North Dakota Petroleum Council, the Saskatchewan Geological Survey and the PTRC – they expanded to include more and more companies. It developed a significant tradeshow component, but it’s been very important to keep the technical and scientific sessions expanding as well.”

“What can you say when you get almost triple the number of people you initially invited to the first conference asking to attend?” notes Wilson, now the CEO of the Petroleum Technology Research Centre in Regina, Saskatchewan. “As the conferences progressed – and began to be managed by the North Dakota Petroleum Council, the Saskatchewan Geological Survey and the PTRC – they expanded to include more and more companies. It developed a significant tradeshow component, but it’s been very important to keep the technical and scientific sessions expanding as well.”

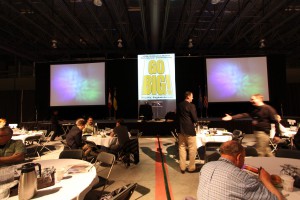

The conference now alternates, in even and odd numbered years, between North Dakota and Saskatchewan respectively. In 2012 over 4000 people registered and attended the Bismarck incarnation (no mean feat, for hotel owners and restaurants in a city of under 60,000) and the 2013 event in Regina is expected to attract around 2500 attendees.

The exponential increase in numbers at the conference speaks to the rise of Bakken exploration and development – a formation that contains often difficult-to-access but high quality oil. The Bakken has become the backbone of the explosive growth in oil production in North Dakota and southern Saskatchewan, and holds enormous potential for additional growth in southwestern Manitoba and Eastern Montana.

What’s in the works for the 2013 conference, which runs April 30 to May 2nd at Regina’s Evraz Place?

“We’re excited by the technical presenters, and special guest speakers we have lined up for this year’s conference,” noted Melinda Yurkowski, assistant Chief Geologist at the Saskatchewan Geological Survey, the Government of Saskatchewan group that has been setting the technical program. “Aside from presentations on important emerging technologies, and the latest in enhanced oil recovery happening in the Williston Basin, our first day of the technical sessions will also report on the latest news from industry and government players.”

“We’re excited by the technical presenters, and special guest speakers we have lined up for this year’s conference,” noted Melinda Yurkowski, assistant Chief Geologist at the Saskatchewan Geological Survey, the Government of Saskatchewan group that has been setting the technical program. “Aside from presentations on important emerging technologies, and the latest in enhanced oil recovery happening in the Williston Basin, our first day of the technical sessions will also report on the latest news from industry and government players.”

To attend the presentations requires registering and paying a fee of 300.00 (this rate goes up on the day of the conference to 500.00, so register early!) but there are also a number of public presentations that don’t require conference registration and are open to everyone. One of those, on hydraulic fracturing (“fracking”) hopes to provide all the basic information on the technologies employed in this process and discuss in a frank way what it’s all about. The conference also has two special workshops planned for the conference delegates for a small extra fee – one on core sampling and a second on rock mechanics. Check out the Williston Basin Petroleum Conference website below for more information.

The some 300 tradeshow booths have been sold out since January, and the tradeshow itself will highlight the best in oilfield technologies. Special events, a host of receptions, and conference lunches with special-guest speakers will also be provided.

The conference runs April 30 to May 2nd at Evraz Place. Visit www.wbpc.ca for full information.