By: Edgar Ang, opisnet.com

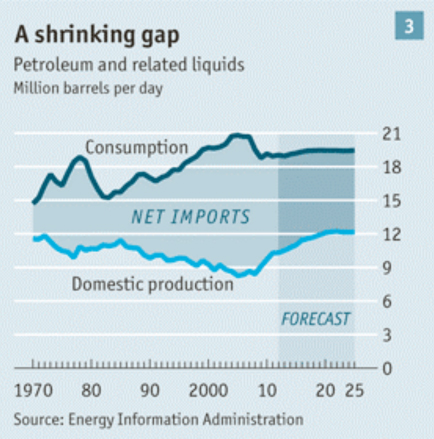

The U.S. may be marching toward the politically charged “energy independence day” amid growing domestic oil production.

However, “the gap between U.S. oil production and consumption is large and may not close in the forecast period (2022),” Credit Suisse said in a report on U.S. oil production outlook.

“North American oil independence (U.S., Canada, Mexico) looks more achievable with appropriate policies to promote safe drilling, energy efficiency, regional coordination and gas substitution. However, we don’t hold out high hopes of the same low cost dividend to the U.S. economy provided by natural gas due to the relatively higher cost of oil shales and Canadian oil sands. Natural gas appears the best low cost energy policy bet,” the bank said.

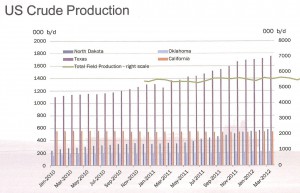

U.S. oil production could reach just over 10 million b/d by 2020 and maintain this level for a number of years, according to Credit Suisse. The strong oil production growth estimate is based on high oil prices, a 27% higher oil well count by 2016 versus 2012, (58% higher than 2011) and a 25% improvement in 30-day initial production (IP) rates per well. Although the well count increases by 27%, the oil rig count only increases by 11% owing to improvements in drilling efficiency, which is defined as the number of days to drill a well.

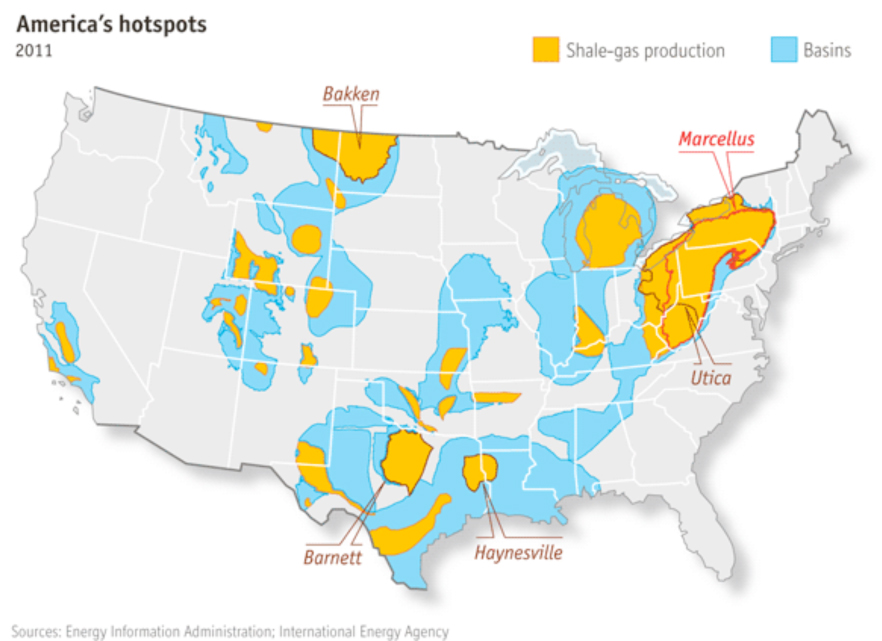

Key shale plays to watch include the Eagle Ford, Bakken and Permian. After recent exploration success, the offshore Gulf of Mexico and potentially Alaska should also contribute some growth.

Single well economics suggest breakevens in the $60-75/bbl range for U.S. shales today. However, driving growth at forecast rates requires substantial capital — access to capital could be a greater constraint.

In a simple calculation, the U.S. oil industry needs around $95/bbl Brent near term to fund the capex required to deliver this growth, based on self-generated cash flow alone. This could be lowered by external funding, but we are already seeing some companies reduce capex when WTI recently fell through $90/bbl.

As U.S. oil production volumes rise, this breakeven could fall toward $80/bbl. It is important to note that the average recovery of a gas well is three to five times the recovery of a typical oil well on a Btu basis. The shale oil revolution should help meet rising global demand but looks less likely to lead to a collapse in domestic pricing similar to U.S. gas markets.

Price Impact

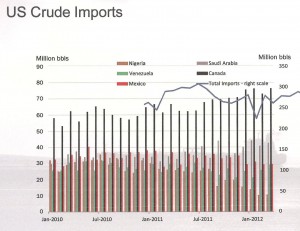

For downstream implications, the U.S. will require new trunkline pipes and gathering system to accommodate 600,000 b/d of annual oil production growth from the U.S. and 300,000 b/d of Canadian annual production growth through 2017, the bank said.

“Our short term model suggests WTI-LLS will remain wide through the second half of 2012 but narrow as Seaway, southern Keystone XL and Permian pipes are built through 2013,” Credit Suisse said. “Even as WTI-LLS spreads narrow, it is likely that a wider discount will remain for Bakken and Canadian Heavy crude through 2014,” it added.

Although oil supply from the U.S. and Canada is visibly growing, outside North America, non-OPEC supply growth is negative in 2012. Oil spare capacity increases towards 3% by 2015 (from 2% today) but markets may still reflect some risk premium over marginal costs, the bank said. “Risks to this view seem balanced. Spare capacity could rise faster if curtailments in Nigeria, Iran, Venezuela, Sudan were resolved. Spare capacity could fall, if a global economic recovery takes hold,” Credit Suisse said.

The rising oil and gas production is also expected to have an impact on the U.S. economy. The bank’s U.S. industry capex model suggests around $1.3 trillion dollars of spend between now and 2020. Low U.S. gas prices should encourage some $35 billion of petrochemical capex and a manufacturing renaissance. The logistics to bring shale hydrocarbons to market could total an additional $80 billion this decade.

Article republished, courtesy of Oil Price Information Service