By: Chris Sutton

Picture taken by Kyle Jerome. Derrickhand with Sun Well Service in North Dakota

The nature of the energy industry can bring frequent changes resulting in professionals reentering the work seeking world. Some of these changes are beneficial for oil and gas companies. For example, acquisitions and divestitures (A&D’s) are a part of the asset allocation strategy for oil and gas companies and are constantly evaluated on both a short and long-term basis.

Operators look for assets where geological knowledge of formations is available, and where technical expertise in specific plays can be leveraged for higher margin recovery. Companies divest assets to raise funding for existing asset development or to acquire new assets more closely aligned with long-term strategic goals.

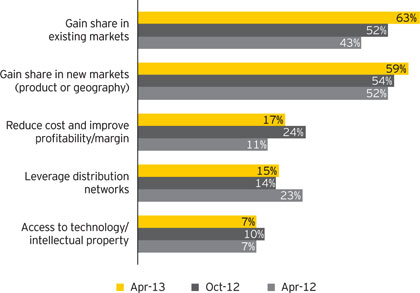

In a survey conducted by Ernst & Young, when Oil & Gas companies were asked to disclose the main causes for an acquisition, the majority of the respondents listed their top two reasons were to gain shares in existing markets and gain shares in new markets.

Although A&D’s are typically beneficial, they can still impact the workforce on either side of the transaction. Other workforce changes are less beneficial – but still somewhat common in the volatile oil industry. For example, if an exploration and production company loses a major project, they will likely have to downsize their workforce by laying off the contractors hired for that project.

Of course, downsizing also occurs for other reasons, such as shifting resources internally and changing company goals. Following are some common scenarios for professionals during company changes, as well as tips for preparing to reenter the workforce.

What do workforce changes mean for oil and gas professionals?

When a company divests an asset, several things can happen to a professional’s job position. Often, the professional will be asked to move with the assets to the acquiring company. Moving to the new company sometimes means relocating, so some professionals will turn down the offer and start by searching for a new job in their area. The divesting company usually encourages current employees to go to the new company if they have the option, because they will be laid off if they stay. Higher-level employees may have the option to accept a retirement package instead of relocating.

In other situations, some professionals might be told the asset is being sold and they’re not being offered a new position at the acquiring company. These professionals are often laid off because they are no longer being used on a project. This scenario is similar to E&P companies losing a major project –some contractors may be asked to join another project or assignment, but usually there isn’t enough work available to avoid downsizing.

What should oil and gas professionals do?

Because the scenarios above are commonplace in the oil and gas industry, professionals in this field should always be ready with a plan of action. Luckily, in the case of A&D’s, professionals are usually given several months of notice before a company divests the asset at which they work and they will know shortly afterwards whether or not they will get an offer from the acquiring company.

Unfortunately, many people don’t start looking for a job until after transitioning out of their role. And in the case of Exploration & Production (E&P) oil companies losing a project, or other downsizing scenarios, professionals may even have less time to ready for a change in employment. This causes laid off and retired employees to enter the job searching market at once including those who do not accept an offer from the acquiring company as well as professionals from the acquiring company who quit. Competition for jobs will be fierce and offered pay may be lower. Our first tip is to begin looking for a job as soon as you know you’ll need one.

Our second tip is to check location. Location can be a deal breaker for professionals who are offered a position at the acquiring company. If you get an offer from the acquiring company, find out if they require relocation. Do some research into the area and decide early whether or not you are willing to move and find affordable housing.

Thirdly, professionals with a lot of experience should consider taking the exit offer and reentering the workforce as a highly compensated, knowledge-based consultant. Taking a retirement offer doesn’t necessarily mean the end of your career.

Lastly, it’s important to continuously network with industry professionals and get to know about projects in your area. This way you will be able to forge meaningful relationships with contacts that can get you in front of hiring managers. Information gained from networking can lead to an easier job transition during a company downsizing or similar situations.

Preparation makes for an easier transition.

Workforce changes are inevitable in the oil and gas industry, and most professionals who work on oil production will switch companies at least once during their career. Preparing for this transition can make finding a new job easier and might even result in a higher paycheck. You can prepare for any possible layoff by learning about companies involved in deals affecting you and by networking with industry professionals, who may be willing to help you quickly transition to a new project.

Good luck and good hunting.

Chris Sutton is a Partner at Clover Global Solutions, LP. He can be contacted at: Chris.S@clovergs.com

North Dakota has pumped up its crude production in August to 914,617 b/d, about 1.1% higher than the revised July output of 904,927 b/d, according to the North Dakota Industrial Commission.

The preliminary July crude output published last month was at 871,459 b/d.

June output was 821,596 b/d, and May production was at 811,262 b/d.

The Bakken crude output makes up more than 90% of North Dakota’s total oil production.

The number of producing wells in August rose to 9,452 from 9,324 in July and 9,096 in June.

North Dakota is the second-largest oil producer in the U.S., with Texas holding on to the No. 1 spot and Alaska third. Bakken crude is playing a growing role in the U.S. coastal refineries’ crude slate as pipelines, rail and ships offer delivery solutions to the once-landlocked crude output.

–Edgar Ang, eang@opisnet.com, www.opisnet.com

Originally published by Oil Price Information Service (OPIS), Gaithersburg, MD. Additional reproduction is strictly prohibited. For more information on other news, contact Scott Berhang, +1 301.287.2332.

For Immediate Release

Contact: Jessica Sena, 590-8675

In response to Tom Power’s, “Drill, Baby, Drill”: The Ongoing Economic Fantasy

In light of a recent commentary by Tom Power (former Economics Professor at the University of Montana) it’s apparent that much education is needed on the issue of America’s energy revolution.

Today, Americans are reaping the benefits of readily available, affordable energy. The United States has just been announced the number one energy producer in the world by Wall Street Journal. Last year, families saw energy savings of $1,200 per household thanks to technological advances in unconventional methods of extraction, according to a September IHS report. The Federal Government’s Low Income Energy Assistance Program spent $3.5 billion dollars on 9 million people last year to help pay energy bills, amounting to just under $400 per person. That being said, America’s private energy sector saved families three times more than taxpayer funded government subsidies.

Today, Americans are reaping the benefits of readily available, affordable energy. The United States has just been announced the number one energy producer in the world by Wall Street Journal. Last year, families saw energy savings of $1,200 per household thanks to technological advances in unconventional methods of extraction, according to a September IHS report. The Federal Government’s Low Income Energy Assistance Program spent $3.5 billion dollars on 9 million people last year to help pay energy bills, amounting to just under $400 per person. That being said, America’s private energy sector saved families three times more than taxpayer funded government subsidies.

Power points out that oil and gas production have increased three-fold in Montana since 1990. He fails to mention in 1990, production levels were tanking. Tax changes throughout the 90’s, including a production incentive passed by the legislature, stopped the decline & led to an increase in oil and gas production, especially via horizontal wells.

Improved horizontal drilling technology partnered with proven hydraulic fracturing released billions of barrels of oil and gas previously thought to be uneconomic to produce. The production increase led to surpluses of new tax revenues at the state and county levels.

In 1990, state and local tax revenues from oil and gas production totaled just over $30 million dollars for cash starved state and local governments, and schools. Almost twenty years later, in 2008, the total production tax revenue from oil and gas was more than $300 million, with over half that amount returning to the counties for school funding, infrastructure, and public programs. Since 2009, oil and gas production levels have remained relatively constant, providing more than $200 million dollars a year in production taxes alone to the state.

According to Power, Montana’s oil and gas industry “was directly responsible of about one-half of one percent of all jobs in the state” in 2011. As of 2012, Montana’s oil and gas activity actually accounted for roughly 3% of jobs in Montana, or almost 30,000 (direct & indirect jobs) according to economist Patrick Barkey of the Bureau of Business and Economic Research.

Oil producing counties represent the state’s lowest areas of unemployment, according to the Montana Department of Labor & Industry. The report from August of this year lists the following Eastern Montana counties at the top of the list; Fallon County, at 1.5%, Richland County comes in second at 2.2%, Sheridan County at 2.2%, McCone County at 2.3%, Carter County 2.3%, Garfield County 2.7%, Wibaux County 2.8%, and Custer Co. at 3%. Compare those numbers to the hardest hit areas; Sanders County at 10.2%, Lincoln County at 12.1% and Big Horn County with the highest unemployment at 14.3%.

Power criticizes the payroll associated with oil and gas jobs, and claims that, “Oil and gas development is not a likely candidate for substantial job creation.” Really?

On the contrary, the Montana Department of Labor classifies natural resource jobs, along with health care and business services, as one of the fastest growing industries in Montana, with a forecasted growth rate of 2.3% between 2014-2021. In terms of wages, Montana’s oil and gas industry paid an average of $56,581 per worker, 75% above the state average in 2012.

One of the most ludicrous statements in Power’s write up, is the assumption that “few people hold up that phenomenon [Eastern Montana oil boom] as an example of how most Montanans would like to live and raise their kids.”

The Montana Petroleum Association has spent the last year on the road and on the phone speaking with families who express the exact opposite sentiment. Many have claimed that without the oil activity, their families “wouldn’t have made it” through the recession. For some, it’s a family affair, with one or more family members working in the oil field; like Robin Schiele of Helena, and his 22 year old son who lives in Missoula, but works in the Bakken.

Before Robin, the family’s patriarch, was hired for a water trucking company in the Williston Basin, the Schiele family, including Robin’s wife and three children, worked 16 hour days caring for lawns just to pay the bills. The Schiele’s are one of many families who’ve said the Bakken opportunities are what saved their family.

As for those living closer to the bulk of the activity, the sentiment’s the same.

At the Montana Economic Development Association’s fall conference on October 3rd in Sidney, Richland County Commissioner Shane Gorder told attendees, “I want to make one thing very clear. I am excited about our economy. I am glad that our children can return home to work in our area. Growth is positive — bringing jobs and opportunities for our communities.”

Last week, Tracy Kessel, a wife and mother living in the oil patch wrote in to the Sidney Herald, “For those of you who are new to our community…Welcome, you couldn’t have picked a better community to be a part of or raise your children.”

After setting the stage to undermine how prolific the recent expansion in energy production has been, Power defends federal agencies, saying, “Whatever federal energy policy has done, it has not restrained energy production in the United States.” The reality is, though, the federal government and environmental agencies have done nothing to increase energy production either, though they love to take credit for the recent success of the private energy sector.

The federal government leases less than 6 percent of its onshore lands for oil and gas development. Under the Obama Administration, the rate of leasing has slowed by about half. According to the Energy Information Administration, in fiscal year 2011, production on federal lands dropped 13 percent from fiscal year 2010 levels, led by a drop in federal offshore production of 17 percent. The majority of oil production on federal lands (around 80 percent) is located in offshore waters. Furthermore, the rate of permitting has also declined by more than one-third.

These facts show that the trend during the current administration has been toward fewer leases and permits for oil and gas drilling and a longer processing time before approval, in contrast to state programs where permits can be obtained in less than a month.

Additionally, federal agencies like Fish and Wildlife Services, and the Bureau of Land Management, are proposing widespread conservation efforts throughout western states which will have a direct negative impact on current and future development.

In Montana, the BLM has released three resource management plans that call for millions of acres to be restricted from oil and gas leases along the Hi-line and in Eastern Montana. The lack of consideration for the economic impact these management plans would have on Montana’s workforce and budget is egregious. Though new management areas will require funding, BLM Director of Montana/Dakotas, Jamie Connell, says she doesn’t know where new money will come from (Sept. 26th TSRIA meeting, Big Sky).

The record is clear that the current administration under President Obama has been a poor steward of our national energy supplies and our economic security. Take the five year delay on the Keystone XL pipeline approval, for example, which is a project that would provide thousands of U.S. jobs, including ample work for labor unions.

Power’s efforts to downplay the economic contribution of oil and gas to state economies is laughable, but what’s worse, is that he completely misses the point of advocating for multiple use access to federal lands.

Our government is at a standstill because of a massive debt problem and the inability of Congress to agree on how to manage the budget. Last year alone, oil and gas production contributed $283 billion in GDP and $74 billion to state and federal revenues, including more than $200 million to Montana’s general fund (in production taxes alone).

A 5% increase in Montana drilling activity would create 366 more direct jobs, 1,025 indirect jobs, and over $20 million a year in additional state and federal revenue.

As the largest economic driver since the recession, the energy sector is poised to help the federal government alleviate the debt crisis; the opportunity to do so might be a “fantasy”…but the ability…that is a reality.

The Montana Petroleum Report provides information of interest to Montanans. We encourage you to forward this to your friends. — Dave Galt, Executive Director www.montanapetroleum.org

The Montana Petroleum Report provides information of interest to Montanans. We encourage you to forward this to your friends. — Dave Galt, Executive Director www.montanapetroleum.org

U.S. OIL BOOM podcast Interview of Bob van der Valk, Senior Editor of the Bakken Oil Business Journal, by Brandon DeShaw, PE, Lab Director, Global Energy Laboratories

I recently chatted with a man that I’ll refer to as the “Yoda” of the U.S. Oil boom.

You remember Yoda from the Star Wars movies, right?

- Spoke in riddles…

- Elderly and ancient…

- Hidden humor…

- Extremely wise…

- Um, well my guy didn’t really speak in riddles.

But he was very wise and had some fantastic insight into the current shale oil boom going on here in the U.S.

This guy is also a highly paid consultant and gives guidance on where fuel prices are headed.

He is the editor and chief guru for the Bakken Oil Business Journal.

His name is Bob van der Valk, and you can actually listen to all his guidance and the interview that I did.

Yes, I finally have published my first podcast episode, and I’m giving you backstage access before I post it on my website.

I interviewed Bob on topics like the next big oil play (hint: it’s in California of all places). We also talked about how to work your way into the oil business.

He talked about where fuel prices are headed in late 2013, and many other topics that will be interesting to you.

Here is the link to the interview:

http://clicks.aweber.com/y/ct/?l=G_ZJ.&m=3jNCFuKQwtqoeBp&b=ZFaLTd.kGLEyYooNJp4uvg

If you go there, you can click on the title and the podcast should autoplay. Or you can hit the download link on that page.

Oh yeah, by the way it’s complimentary. I don’t even sell anything (yet) on the podcast.

It should also be listed on iTunes soon, if you want to go there and search for “oil boom” podcast.

Anyway, this interview was a real gem, and I wanted you to get first “dibs” on it.

Later.

Thank you,

Brandon DeShaw, PE

Lab Director

Global Energy Laboratories

200 Technology Way

Butte, MT