Opinion Article

“Phelim We Hardly Knew Ye”

By: Bob van der Valk

Dateline: Terry, Montana

June 27, 2013

This opinion article deals with FrackNation as a pro-hydraulic fracturing for oil & gas documentary. Comments, other than my own, were made by individual landowners in the Pennsylvania area where the controversy about hydraulic fracturing had its inception.

Bob van der Valk

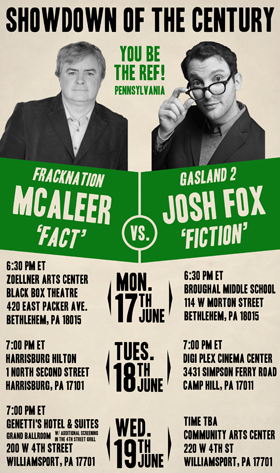

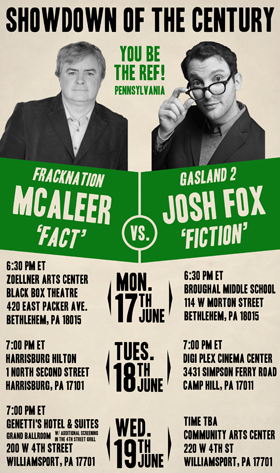

FrackNation’s Phelim McAleer has been able to hit Josh Fox’s Gasland and Gasland Part II movies with his best shot making his points about hydraulic fracturing not being the cause for underground water contamination. Neither is the methane produced by the drilling process resulted in any of the health problems purportedly suffered by land owners where the drilling has been done.

For the last two years Phelim McAleer has made it his life’s calling chasing Josh Fox around the country peppering him with embarrassing questions about ridiculous charges being made in the original Gasland movie. Gasland was nominated for an Oscar as the Best Documentary of 2010. Most, if not all, of the charges made by emotionally and financially driven opponents to hydraulic fracturing drilling for natural gas have been debunked by Federal and State agencies, which became involved by reacting to the public attention Gasland initially received.

Recently Phelim McAleer has been showing his FrackNation up against Gasland Part II. This is leading up to the HBO-TV premiere of Gasland Part II on July 9, 2013. FrackNation will be shown again on AXS-TV July 10, 2013 both of them will get high viewer ship for both cable channels.

What has been lost in this conversation about hydraulic fracturing is the US becoming energy secure once again of having to import crude oil from countries with governments hostile to our way of life. Neither Josh Fox nor Phelim McAleer one have oil industry experience and are continuing this unnecessary raucous to promote themselves.

Sherry Hart

After the Binghamton, New York, February 10, 2013 showing of FrackNation a question was asked by Craig Stephens addressing Phelim McAleer, the producer of FrackNation, about the December 15, 2010 “Dimock Consent Order and Settlement Agreement” (COSA): http://files.dep.state.pa.us/OilGas/OilGasLandingPageFiles/FinalCO&A121510.pdf

Similar to what has happened since the beginning of the Dimock saga, the actual contents and findings of the COSA frequently get overlooked while pro-drillers and drilling opponents continue to banter with each other about the water being poisoned, no it wasn’t, etc. Phelim’s brief answer to Cabot’s move to settle was that it was a case of corporate business as usual and happens all the time. Partly true, but anyone who has been following the Carter Road allegations and its resulting mounds of paperwork and legal filings for the last couple of years are familiar with a few things above and beyond his answer:

The PA DEP claimed identification of the migrating gas as being from Cabot’s wells primarily using “presumptive guilt”, based only on proximity to the well, and explains their findings in a the original COSA dated November 4,2009 (http://www.marcellus-shale.us/pdf/Cabot_Consent-Order_11-4-09.pdf) which states starting in January 2009 PA DEP collected samples from water wells providing water to 13 homes which showed elevated levels of dissolved methane as well as identified combustible gas in the headspaces of seven of those water wells.

After the COSA was established, Cabot hired an independent consultant to perform a separate investigation. According to a review of data on the same exact wells determined to be problematic by PA DEP, Robert W. Watson, Ph.D./P.E. and Associate Professor Emeritus of Petroleum and Natural Gas Engineering and Environmental Systems Engineering, etc. concluded that Cabot was using procedures for drilling, casing and cementing wells even at that time which met or exceeded the requirements of the Pennsylvania Oil & Gas Act, were adequate to protect the drinking water, and which did not cause or allow methane migration into the drinking water. (http://www.cabotog.com/pdfs/Dr_Bob_Watson_WhitePaper_101010.pdf – page 2 and again in the Conclusion on page.

Based upon those findings, and mostly those findings alone, because all of the water supplies were within 1,300 or less feet of a Cabot well and because those wells were drilled within the preceding six months, PA regulations deem a determination of guilt can be made. (page 3-4, articles J-K): The Pennsylvania Oil & Gas Act: A Summary of Statutory Provisions dated March 2009, Section 208: Protection of Water Supplies (58 P.S. § 601.208) (page 4) states, in part, “There is a refutable presumption that a polluted water supply located within 1,000 feet of a well is caused by the well.” http://law.psu.edu/_file/aglaw/SummaryOfPennsylvaniaOilAndGasAct.pdf This Summary was written prior to pre-drill tests becoming mandatory, which if anything could well be the most important lesson learned in Dimock.

Other information that could be pertinent is in the legal filings of the lawsuit itself:

1) The Dimock litigants fired their original lawyer when another better known litigation firm offered to take them on as clients. They walked out leaving $650,294.18 in legal fees unpaid. 2) When the revised COSA was finalized, settlement amounts of the plaintiffs totaled $2,234,160. (2011-11-30 2010 COSA Settlement amounts.jpg). Amounts of the settlement varied depending on individual property appraisals. These funds were put into an escrow account to be claimed by December of last year. There were no restrictions put on this money; it was free for them to collect and they could still continue with their lawsuit and water deliveries would continue. (2011-12-16 DEP and Cabot Rev Consent Order and Settlement Agreement.PDF)

3) Their original lawyer caught wind of this settlement and put a lien on the escrow account for the outstanding fees the litigants had not paid. (2011-01-12 Motion to demand fired attorneys fee.pdf)

4) All those persons within the determined effected area and not involved in the lawsuit, claimed their money. None of the litigants did because doing so would mean paying their first lawyer. This got muddled in their lies of how Cabot was forcing them to sign non-disclosure agreements and quit the lawsuit… all of which is written into the contract that the money is theirs – no restrictions on it.

5) In August, most of the litigants settled, but do have to abide by a gag order regarding the settlement amounts or findings. Also, the money contained in the escrow account set up per the COSA goes back to Cabot. Thus Dan Dinges statement, “The aggregate value of the settlements are not a material item with respect to Cabot’s financial statements,” (statement found in the Philly.com article referenced below.) I believe there is currently only one remaining holdout, Ray Kemble, who spoke to the Philadelphia Inquirer soon after the settlement offers were made and accepted by the majority of the litigants. He mentions what his settlement offer was and it appears it was pretty close to the same amount originally offered him in the COSA. (Per Philly.com: http://articles.philly.com/2012-08-27/news/33403570_1_susquehanna-county-town-cabot-oil-baby-drill) “Kemble is angry at just about everybody – Cabot, regulators, his own lawyers, and his ex-wife, who accepted the settlement, thereby reducing the amount offered to him. He said he would only see $79,000 from the deal, after legal fees.” His ex-wife was entitled to half the amount offered, thus twice the amount Kemble states he was offered is $158,000. Originally the COSA provided for a settlement offer of $185,712.00.

6) Thus, it appears the litigants were offered just slightly less the amount originally offered without having to access the funds that had liens on them, probably due to lawyer’s cuts, etc. Settlement discussions began soon after the third set of water test results were released showing, once again, the water tested within acceptable drinking water standards.

This is why Phelim’s response fell far short and was merely the tip of the proverbial iceberg.

Robin Fehrenbach Scala

Are you hearing that Phelim is actually on the other side? Or is it a setup so both can profit from the argument and their respective films? Having met and argued with Josh Fox even before his film came out, I know he is a liar and expect no truth to ever come from his mouth.

It was later that I was contacted by Magdalena Segieda, who is the Director and Producer of FrackNation, in an effort to find people in my area who were drilled and would talk on camera for the film. I met her first and we made some initial contacts, then Phelim and the film crew came out and spent a whole day in my house getting possible scenes with me and Sherry Hart talking about our issues and showing us working the boards and contacting landowners and politicians. (Of all those hours we appear for exactly 2 seconds maybe, which we were happy about).

HBO is trying to justify their financial backing of Gasland and Part II (and Fox in general) so it seems like a good time to spread information, which could be used against Phelim or make him seem like he is just as bad as Fox.

I also provided money to be executive producer and was involved from before the film was a film. There IS one way to prove who is right, and that is to follow the money. If HBO is really paying for ANYTHING they could prove it. But they won’t. I trust HBO less than a guy sitting on a street corner with a hat waiting for spare change. Ask them to prove it. They can’t.

By the way, HBO DOES NOT put up those posters. Phelim does and has since the beginning. It started from his first argument with Josh, where he asked if Josh knew about methane being in the water since the dawn of time, and Josh said, “It is not relevant”

Game On!

Now Phelim makes sure that if Gasland Part II is being shown, FrackNation is also being shown in the same town, biting at the bit for the debate with Josh, but there’s no point holding his breath!

At least HBO did not pay for FrackNation or any part of it or any advertising for it. They DID pay for Gasland and Part II and are now sucking eggs over it.

I never read the account about the arrest of the Julia Mineeva, the former Russian TV anchor, at the premiere of Gasland Part II or if her arrest for trespassing was a set up. I do know that Josh Fox set up his own arrest (complete with his cameras rolling) at a committee hearing in the House of Representatives so he could use it in Gasland Part II.

The only reason I feel I can stand up for Phelim (though I could be wrong…it is always possible to be wrong) is due to his behavior on all other occasions where I have been with him or them, watching how they react.

See, I am the type who would make the movie and then go broke because I did not attempt to make money for travel and distribution. The movie would then be a waste of time and investor money.

I would hope that Phelim is making SOME kind of money so he does not go broke (as I would, which is stupid) trying to get the word out.

If anyone is being a money hog and pretending to actually care, it is Josh Fox, who will admit it to anyone everywhere except when asked during a screening.

Being a landowner in PA and NY, I felt like I hit the lottery when Phelim and company contacted me to help make the movie. I had no way to educate the public on my own and attempts to find a spokesperson died after speaking to an agent for an hour while finding out what it would cost to get the person I wanted.

Bob van der Valk

FrackNation exposed Josh Fox for the publicity seeker he is. The oil industry needs to have a serious discussion about the urban lies being spread by the likes of Josh Fox. Phelim did a good job on FrackNation and accomplished just that. He is a journalist and should have stuck to bringing out the true facts about hydraulic fracturing. But we need an independent journalist to tell the true story on how to go about making the US energy secure. The next frontier will be in California with the Monterey Shale Formation coming into play. Their potential reserves of oil & gas is 3 times bigger than Marcellus, Eagle Ford & the Bakken combined.

Robin Fehrenbach Scala

You just explained your position so it makes total sense to me. Phelim has become the story.

Thanks for continuing our conversation until I could “get it”.

Bob van der Valk

God bless the USA!

This editorial was written with the assistance and input of:

- James Asbury – Mansfield, Pennsylvania

- Robin Fehrenbach Scala – Factoryville, Pennsylvania

- Sherry Hart – Tunkhannock, Pennsylvania

Disclosure: Bob van der Valk, Robin Fehrenback Scala and Sherry Hart donated funds to the Kickstarter program and are credited as Executive Producers of FrackNation.

GOT AN OPINION ?

Visit our Facebook page & let us know what you think.!

https://www.facebook.com/BakkenOilBusinessJournal

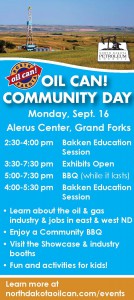

BISMARCK, ND – The North Dakota Petroleum Council (NDPC) today announced that legendary Notre Dame football coach Lou Holtz will provide a keynote address during the NDPC’s Annual Meeting to be held Wednesday, Sept. 18 at the Alerus Center in Grand Forks, ND. Holtz took his Notre Dame teams to nine straight New Year’s Day bowl games from 1987 through 1995 and remains 11th on the NCAA all-time win list for Division I-A coaches.

BISMARCK, ND – The North Dakota Petroleum Council (NDPC) today announced that legendary Notre Dame football coach Lou Holtz will provide a keynote address during the NDPC’s Annual Meeting to be held Wednesday, Sept. 18 at the Alerus Center in Grand Forks, ND. Holtz took his Notre Dame teams to nine straight New Year’s Day bowl games from 1987 through 1995 and remains 11th on the NCAA all-time win list for Division I-A coaches.