By: Chris Sutton

Picture taken by Kyle Jerome. Derrickhand with Sun Well Service in North Dakota

The nature of the energy industry can bring frequent changes resulting in professionals reentering the work seeking world. Some of these changes are beneficial for oil and gas companies. For example, acquisitions and divestitures (A&D’s) are a part of the asset allocation strategy for oil and gas companies and are constantly evaluated on both a short and long-term basis.

Operators look for assets where geological knowledge of formations is available, and where technical expertise in specific plays can be leveraged for higher margin recovery. Companies divest assets to raise funding for existing asset development or to acquire new assets more closely aligned with long-term strategic goals.

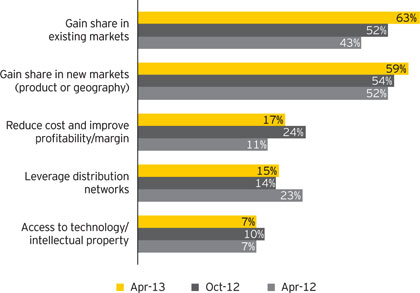

In a survey conducted by Ernst & Young, when Oil & Gas companies were asked to disclose the main causes for an acquisition, the majority of the respondents listed their top two reasons were to gain shares in existing markets and gain shares in new markets.

Although A&D’s are typically beneficial, they can still impact the workforce on either side of the transaction. Other workforce changes are less beneficial – but still somewhat common in the volatile oil industry. For example, if an exploration and production company loses a major project, they will likely have to downsize their workforce by laying off the contractors hired for that project.

Of course, downsizing also occurs for other reasons, such as shifting resources internally and changing company goals. Following are some common scenarios for professionals during company changes, as well as tips for preparing to reenter the workforce.

What do workforce changes mean for oil and gas professionals?

When a company divests an asset, several things can happen to a professional’s job position. Often, the professional will be asked to move with the assets to the acquiring company. Moving to the new company sometimes means relocating, so some professionals will turn down the offer and start by searching for a new job in their area. The divesting company usually encourages current employees to go to the new company if they have the option, because they will be laid off if they stay. Higher-level employees may have the option to accept a retirement package instead of relocating.

In other situations, some professionals might be told the asset is being sold and they’re not being offered a new position at the acquiring company. These professionals are often laid off because they are no longer being used on a project. This scenario is similar to E&P companies losing a major project –some contractors may be asked to join another project or assignment, but usually there isn’t enough work available to avoid downsizing.

What should oil and gas professionals do?

Because the scenarios above are commonplace in the oil and gas industry, professionals in this field should always be ready with a plan of action. Luckily, in the case of A&D’s, professionals are usually given several months of notice before a company divests the asset at which they work and they will know shortly afterwards whether or not they will get an offer from the acquiring company.

Unfortunately, many people don’t start looking for a job until after transitioning out of their role. And in the case of Exploration & Production (E&P) oil companies losing a project, or other downsizing scenarios, professionals may even have less time to ready for a change in employment. This causes laid off and retired employees to enter the job searching market at once including those who do not accept an offer from the acquiring company as well as professionals from the acquiring company who quit. Competition for jobs will be fierce and offered pay may be lower. Our first tip is to begin looking for a job as soon as you know you’ll need one.

Our second tip is to check location. Location can be a deal breaker for professionals who are offered a position at the acquiring company. If you get an offer from the acquiring company, find out if they require relocation. Do some research into the area and decide early whether or not you are willing to move and find affordable housing.

Thirdly, professionals with a lot of experience should consider taking the exit offer and reentering the workforce as a highly compensated, knowledge-based consultant. Taking a retirement offer doesn’t necessarily mean the end of your career.

Lastly, it’s important to continuously network with industry professionals and get to know about projects in your area. This way you will be able to forge meaningful relationships with contacts that can get you in front of hiring managers. Information gained from networking can lead to an easier job transition during a company downsizing or similar situations.

Preparation makes for an easier transition.

Workforce changes are inevitable in the oil and gas industry, and most professionals who work on oil production will switch companies at least once during their career. Preparing for this transition can make finding a new job easier and might even result in a higher paycheck. You can prepare for any possible layoff by learning about companies involved in deals affecting you and by networking with industry professionals, who may be willing to help you quickly transition to a new project.

Good luck and good hunting.

Chris Sutton is a Partner at Clover Global Solutions, LP. He can be contacted at: Chris.S@clovergs.com