The 20 million barrels of drawdown in a sluggish economy

By: Dian Chu – EconMatters

In the last two weeks crude oil inventories fell by a record 20 million barrels, this event has not happened in over 30 years of historical data. So what the heck is going on here? It is not the case this is the best economy in the last 30 years. It sure isn’t the case Americans are using more fuel right now compared with any other time period during the last 30 years.

Peak Demand Era

In fact, the US market is maturing and using less fuel these days for several reasons like available subsidized alternative energy, higher fuel efficiencies, fuel blending requirements, and a struggling economy with the highest rate of population on food stamps.

Supplies at Record Highs

Sure refiners are running at their highest rate of the year in the 92% range, but that is all normal for this time of the year. Yet this two week drawdown has never happened before, and curiously it happened as supplies were at record highs.

Increase in Domestic Production Matches Reduction in Imports

Something is rotten in Denmark and it appears there is some funny business going on once again in the oil market. What makes the drawdown even more suspicious is domestic production was very high the last two weeks at 7.2 and 7.4 million barrels per day, with imports down to 7.4 and 7.5.

The imports are low when compared to last year, which was 8.6 million barrels for the same week a year ago. At first blush this may the reason for the drawdown, just take a million barrels per day times seven days in a week, and it adds up to a 7 million barrels weekly deficit.

But then you compare domestic production to last year and it is up 1 million barrels per day compared to this time last year. So the trend of replacing Saudi oil with domestic oil continues on its natural course given the recent industry trends.

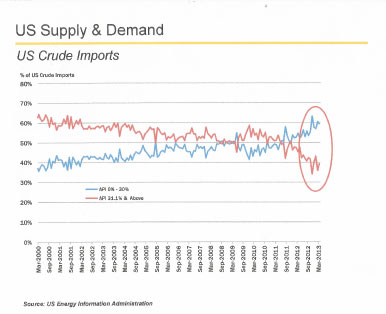

US crude oil imports have reversed itself in from 60-40 in 2000 to 40-60 percent in 2013

Where is Saudi and Nigerian Oil Going?

A couple of points worth noting: What is Saudi Arabia doing with their extra capacity now that they are no longer exporting this oil to the US? It sure isn’t going to China; it is not like their economy is booming right now. It sure isn’t Europe as they are a mature market with automobile sales at 20 year lows and high unemployment!

I know that there is a lot of Nigerian Oil just sitting on tankers waiting for buyers because the United States isn’t importing as much of this oil given the higher quality domestic production, but what about Saudi Arabia? What are they doing with the overproduction of crude oil, which used to be exported to the US?

What Is The Real Reason Tanker Rates are Rising?

Tanker rates have been rising lately. Is the real reason they are rising a vast amount of crude oil is being taken off the market then stored in ports around the world to artificially raise prices? It wouldn’t be the first time this price firming trading gimmick has been utilized by the big players in the industry. It is not because Saudi Arabia has reduced production in a significant manner. To account for where their excess capacity, with most of it destined for delivery to the US, is now being delivered the only explanation a vast amount of crude oil is being stored in Very Large Crude Carriers (VLCC) in ports around the world.

Managing the Market

But the trend is clear; If Saudi Arabia was sending the same amount of crude oil to the US and along with the increase in US domestic production currently, oil prices could be much lower. They are trying to manage crude oil prices and the supply glut by offsetting the increase in US domestic production by exporting less to the US.

For example last June 22, 2012 the US imported 9,118 (million barrels per day) for that week ending period, and the US has imported up to 11,153 (million barrels per day) for a July period as recently as 2010.

The other question is what does Nigeria do with all their extra sweet crude oil right now? This much wanted oil has to hit the market at some point given some degree of reduced market price. Nigeria badly needs the revenues so they cannot just keep this oil in the ground.

Lack of Huge Product Builds

The other interesting oddity about the drawdown is overall finished product supplies didn’t have huge builds the last two weeks. For example last week distillates had a 3 million build, and gasoline had a 2.6 million drawdown. The prior week both products had moderate drawdowns. The conventional wisdom is of refiners ramping up production, therefore drawing down from crude oil inventories and building up finished product inventories.

A 92% refinery utilization rate is normal for this time of year, but it is apparent given the numbers not all of this oil went towards refining products. So where did it go? Ergo the big question!

The Math Just Doesn’t Add Up!

Because if you add up the numbers it doesn’t equate: Take domestic production for two weeks, add the import numbers for two weeks, add the refinery inputs for two weeks, the refinery outputs for two weeks, and the draws in product inventories for two weeks, there is no way to account for this record breaking two week draw in oil supplies.

A lot of this oil isn`t being captured in the refining supply chain statistics, so the oil went out of storage, the official storage numbers went down, but it wasn`t all processed into products, so where is it being stored?

It is obvious that something is amiss in the data as the US didn`t suddenly allow for large exporting of oil, not that there would be a market for it anyway under current global conditions! My best guess is that this oil is being moved from the official storage facilities that have reporting responsibilities to other storage facilities of some kind not captured by the EIA reporting requirements.

Purposeful Manipulation or System Reporting Glitch?

Another possible explanation is whether this is for explicit purposes is the manipulation of the inventory numbers to affect price is another question or a system which has flaws in accounting method used for oil being moved from one storage facility type to a different kind of storage facility.

Oil Market is Being Well Supplied

But the main takeaway is that the recent drawdowns doesn’t reflect any change in supply and demand fundamentals in the market. This is an accounting anomaly whether for purposeful manipulation or system failure of the data.

There Are Two Sides to Every Transaction: Excepting Fake “Accounting Trades”

Some analysts have been talking about another big drawdown for this week because the market is in backwardation. The rationale is that why would you hold onto oil if you are going to get a lower price next month, so sell all you can now!

Well, what about buyers? Every transaction has two sides: Why would a buyer acquire oil this month when it can be acquired next month at a cheaper price, and in two months it is even cheaper? It is not like there is any shortage of oil right now!

System Constraints on Volumes

If we experience another large draw something funny and potentially fraudulent is going on in the oil industry because there is no way this oil is being refined into petroleum products. The system just cannot handle these types of volumes in three weeks without domestic production or oil imports dropping off a cliff, which they haven’t!

History of Oil Market Shenanigans

Oil is either being taken out of storage and stored on tankers to artificially have the appearance of tighter supply markets, and thus influence price, and will be dumped back on the market at a later date; or some other market shenanigans are taking place where this crude oil isn’t making its way into the refining supply chain at all.

It wouldn’t be the first time traders found a way to game the system in the energy markets. There is a long and storied history of just such behavior from Enron to J.P. Morgan. But something’s fishy and just doesn’t add up right now in the oil market!