By Robyn L. Erlenbush, robyn@eralandmark.com

By Robyn L. Erlenbush, robyn@eralandmark.com

See NAI/ERA Landmark in the Oct/Nov issue of the Bakken Oil Business Journal

One of the more challenging personal experiences I had during the “Great Recession of 2008-2011” was watching hard working families in Southwestern Montana lose their homes to short sales and foreclosures. Through circumstances not of their own choosing, many lost jobs, had medical challenges, or could not find work, and they were left with no choice but to walk away from their homes. As I spent many hours listening to their stories and trying to advise them on options, I felt like a grief counselor, watching the different stages of emotion – first denial, then anger, sadness and finally acceptance. For many, their personal identity and self-worth was attached to where they lived and how they kept their home. Their family unit was defined by their street address. We sold countless distressed homes that were left in perfect condition down to murals on the children’s bedroom walls and well-tended gardens.

This property was listed for $3,625,000 in 2009. We re-listed it for a national bank for $1,499,900. Sold at auction at undisclosed price.

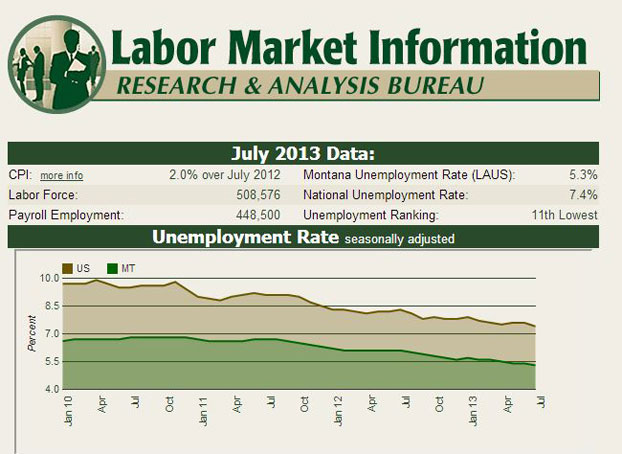

There were three glimmers of hope that caused many Montana homeowners to live to see another day. First, the economic mini-boom of 2008 (The Big Hail Storm) helped put many unemployed construction workers back on roofs to bring in enough income to cover house payments. We experienced another mini-boom in 2010 (Big Hail Storm #2) with broken windows, marred siding, and destroyed roofs adding up to big business for workers and construction related industries. The third saving grace for many of the unemployed was the robust job market in eastern Montana and western North Dakota. We are finally experiencing positive strides in our local job market with Gallatin County’s 2012 annual unemployment rate down to 5.3% after a high of 6.5% in 2010. This follows the trend of the statewide 2012 rate at 6.0% down from 6.8% in 2010. Even more impressive is Richland County’s data, which is from eastern Montana including Sidney, where 2012 weighed in at 2.7% last year.

In the Bozeman and surrounding areas during in the time period between January 2007 and December 2012, there were 320 short sales and 386 foreclosures reported through our MLS data. This includes single family homes, condos and townhomes in the Bozeman area, Park County, Big Sky and west to Three Forks. These numbers are most likely lower than the actual amount since mandatory reporting of these categories did not exist for the entire time period. Furthermore, many of these sales can take place on the courthouse steps or between private parties. So where are some of these previous homeowners and what are their options for future ownership? Well, many have moved back to the Gallatin Valley and are gainfully employed in a booming construction industry. And as far as their opportunity to buy a home, the outlook continues to improve.

In the ever changing world of mortgage lending, it is often hard to keep up to date. As recently as mid-July, the headlines were full of information about “Boomerang Buyers” – people who lost their homes due to short sales, foreclosures, and bankruptcy and were just beginning to show a presence in the real estate market once again. At that time, Realtor Magazine anticipated that almost one in five sales in the metro Phoenix area (one of the hardest hit short sale and foreclosure markets nationwide) was a boomerang buyer. These buyers worked on saving down payments and want to own again before interest rates and housing prices gain momentum. Typically, buyers needed to wait 5 to 7 years before even considering applying for a new mortgage. Those who participated in a short sale generally had a shorter wait than foreclosures.

Skip ahead to mid-August to captions such as “Boomerang Homebuyers Get a Shorter Ride Home.” On August 15, 2013, the Federal Housing Administration (FHA) made changes in its guidelines for those who lost their homes due to financial stresses. The new rules under “Back to Work – Extenuating Circumstances” have reduced the amount of time to be eligible for financing from 36 months to as few as 12 months for many. If the boomerang buyers can provide documentation that a “specific Economic Event” caused a 20% or greater decline in their income for at least 6 months which resulted in a short sale, foreclosure, or bankruptcy, they may be back on the road to home ownership. Buyers must be able to show that the hardship was a one-time event which is not likely to happen again and proof of stability for the prior 12 months must be provided. For those whose losses were truly due to the status of the economy versus personal financial choices, this is extremely good news in that they may be able to become homeowners again sooner than anticipated.

Among the frequently asked questions is where to start this process. The first step is to find an FHA-approved lender and check mortgage rates. The lender will require documentation of the 20% loss of household income; therefore, if only one wage earner had decreased income, the household may not be eligible. The loan size is only dictated by the local area’s FHA loan limit. Borrowers must take a housing counseling course. Once many of these first steps are completed, it is time to start house shopping – though the program will be in effect until September 30, 2016.

Robyn L. Erlenbush is a third-generation Montanan who lives in Bozeman, MT. She is the broker/owner of ERA Landmark Real Estate (with offices in Bozeman, Big Sky, Livingston and Clyde Park), NAI Landmark Commercial and Intermountain Property Management. She can be reached at robyn@eralandmark.com.