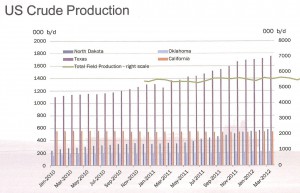

Emerging markets have also revived America’s role as a big commodity producer. Soaring grain exports have raised farmers’ incomes to record levels, and regulators fret about incipient bubbles in agricultural land. At the same time, surging oil prices have triggered a gusher of new output. In 2011 crude-oil production reached its highest level since 2003, of 5.7m barrels a day (b/d). Production in the Gulf of Mexico is almost back to the levels reached before the Deepwater Horizon oil spill of 2010.

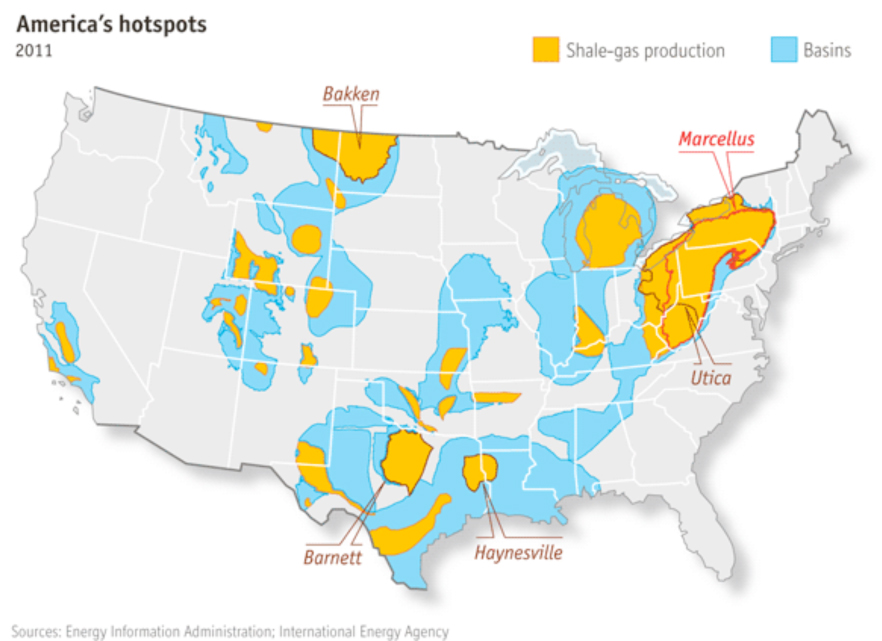

In recent years, techniques have been discovered to release gas from densely layered rock formations known as shale. These techniques—horizontal drilling and hydraulic fracturing, or fracking—have released so much shale gas that its price has tumbled (see our special report). Now the same methods are being applied to race after oil.

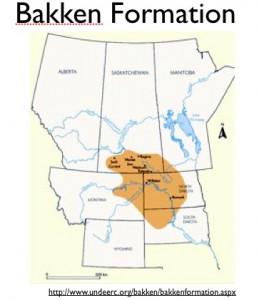

In 1999 North Dakota’s rig-count stood at zero after small pockets of conventional oil had run out. Now the Bakken oilfield is pumping out more than 550,000 b/d of shale oil, and Williston, the town at the centre of the field, is booming. It used to take five minutes to cross town; now the weight of oil traffic means it takes 20, according to one resident of this remote corner of a thinly populated state. At Walmart, crowds of shoppers have pressed all the trolleys into service; and its vast car park, like many other similar sites in town, provides a temporary home for fleets of camper vans housing workers flooding to the region’s oilfields. New homes, hotels and “man camps”—row upon row of workers’ huts—are springing up all around.

This year shale oil should contribute some 720,000 b/d to America’s total production. And shale-oil deposits in Texas, Ohio, Nebraska, Colorado and Kansas could eventually contribute as much as 5m b/d, according to the most optimistic forecasts. The Bakken field may well hold more than people think, and Ohio’s Utica shale has barely been tapped.

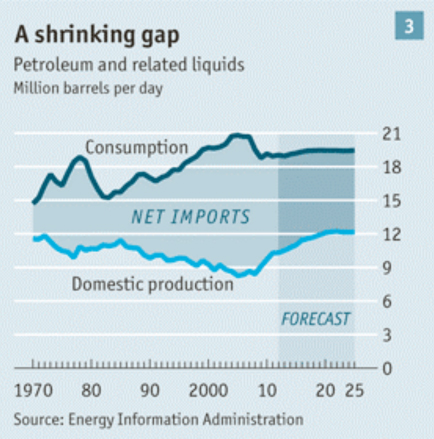

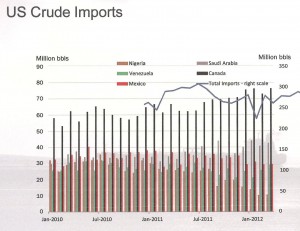

America is the world’s third-largest oil producer. The deep waters of the Gulf of Mexico could yield substantially more oil (perhaps 1m-2m b/d on top of the 1.3m b/d currently produced). America has plenty of other places where it might look if unfettered drilling were allowed, such as the east and west coasts and restricted parts of the Gulf of Mexico. Oil production in Alaska could also be expanded. America now imports 9m b/d; by “going back onshore” and exploiting all its options, optimists think it could produce 7m more b/d in a decade or so. Daily net imports of crude oil this year are the lowest since 1995, and will probably keep falling in the coming years (see chart 3).

Not so long ago, terminals were still being built in America to import liquefied natural gas (LNG). Now the country is enjoying a bonanza of domestic gas. Americans pay less than $3 for 1m British thermal units, where Europeans and Asians often pay more than $10. Accordingly, America is now planning to send the stuff abroad. Michael Levi of the Council on Foreign Relations thinks that exports of 60 billion cubic metres a year would yield revenue of $20 billion, though higher imports of other goods would offset the benefit to the trade balance.

“America’s economy. Points of light – Amid the gloom there are unexpected signs of boom, especially in energy.” (2012-7-14). The Economist. Retrieved 2012-7-24.