Opponents of the Keystone XL tar sands pipeline have built a small fortress high up in trees and on land in northeast Texas to block construction of the controversial project’s southern leg.

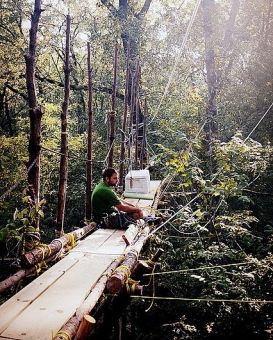

As many as 20 protestors are stationed in 80-foot-high tree platforms, on the ground or along suspended timber bridges that cut through the old-growth forest in Winnsboro, a town about 100 miles east of Dallas.

The civil disobedience action—which has been marked by arrests and accusations of police abuse—entered its fourth day on Thursday.

The Tar Sands Blockade, the activist group behind the effort, has carried out smaller protests since early August, when Canadian energy company TransCanada began construction in southern Texas and Oklahoma on the 485-mile-long segment. But this week’s demonstration is its biggest yet to oppose the pipeline.

Local police arrested two people on Tuesday—Shannon Bebe of Dallas and Benjamin Franklin of Houston—after they chained themselves to a large excavator used to clear the forest surrounding the encampment. Ron Seifert, a spokesperson for the Tar Sands Blockade, alleged the local police put Bebe and Franklin into stress positions, including wrenching their arms behind their backs and handcuffing their hands to the equipment. He said they used pepper spray and taser guns until the activists agreed to remove themselves. Seifert contended that TransCanada supervisors were present during the debacle.

TransCanada did not return requests for comment by deadline.

The Tar Sands Blockade bailed out Bebe and Franklin on Tuesday evening for $2,000 each.

Via telephone from a tree platform, Seifert told InsideClimate News that the group plans to continue as long as they possibly can—so long as TransCanada doesn’t attempt to fell the trees they’re stationed in. (Though he added that he doesn’t expect that to happen.)

Editor’s note: In a press release issued Thursday afternoon, the Tar Sands Blockade said TansCanada was operating “heavy timber clearing machinery within 20 feet of the site” of the tree blockade.

Protesters are fully equipped with food supplies and safety equipment thanks to donations from nearby communities and financial contributions on its website, Seifert said. Protestors can move throughout the aerial blockade using zip lines and timber catwalks. Barring the “ominous sound of chainsaws and heavy equipment in the not-so-far distance,” the protestors’ tree village is quite comfortable, he said.

Seifert said he hopes the protest will inspire more civil disobedience along the pipeline route.

Keystone XL protester in tree. Credit: Tar Sands BlockadeKeystone XL protester in tree. Credit: Tar Sands Blockade

TransCanada has said the Oklahoma-to-Texas leg of the Keystone XL should be up and running by mid- to late-2013. Construction began in Texas on Aug. 9 after the pipeline received government approval in July.

The fate of the northern leg, however, is less certain.

That portion, which would stretch 1,215 miles from Alberta, Canada, to Cushing, Okla., requires approval from the U.S. State Department because it would cross an international border. Concerns about the pipeline’s impact on the ecologically fragile Nebraska Sandhills and on the Ogallala aquifer, a crucial water source for the state, prompted Pres. Obama to delay his decision on the segment until after the November election.

Seifert said the Keystone XL pipeline, designed to carry 830,000 barrels of oil sands crude to the Texas Gulf Coast, is “more than just a permanent scar on the land that’s directly affected by construction—this is about the future of our entire planet.”

Oil sands production consumes more energy than pumping conventional oil up from a well, because it must be strip-mined or boiled loose underground. Greenhouse gas emissions from Canadian tar sands production are about 82 percent higher than the average crude refined in the United States, according to estimates by the Environmental Protection Agency.

“Stopping this pipeline is one of the necessary things we have to do based on a future of runaway climate change,” Seifert said.

Maria Gallucci, InsideClimate News (9-27-2012). Retrieved 9-28-2012.